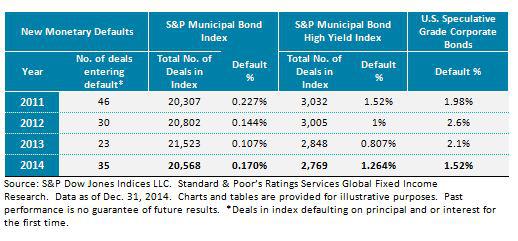

While the pace of issuance is likely to pick up, it is expected to be relatively muted compared to levels over the past five years. economic recessions, defaults in the municipal bond market have been negligible on both an absolute basis and compared to the corporate bond market, as munis have registered a cumulative average 10. Over the last 50 years, a period that has included seven U.S. Another positive factor in muni bonds’ favor is their historically low default rates.

#Municiple bond defaults download#

The greater default risk going forward is losses stemming from government supported green bond projects as well as energy related companies or projects which are being negatively impacted by the environmental politics of today. Download Sign up for insights Key takeaways Municipal bonds produced positive performance in the first quarter, despite continued volatility in U.S. Looking at defaults & credit-rating actions. This will mean that future defaults among previously distressed issues will be higher as bondholders discover reality.Īs we note in another report today, the actual default picture for 2023 has stabilized at pre-covid levels. The results in 2022-23 would also benefit from the decline in new projects during the Covid lockdowns and the fact that many project defaults were brought forward to 2020-21, projects that found the lockdowns a convenient excuse to negotiate standstill agreements with bondholders despite their woes being unrelated or self-inflicted. (There were no rated municipal defaults in 2018.) Second, muni bonds continued to be highly rated in 2018, with more issuers upgraded than downgraded. An accompanying article goes into depth on this effect in 2020-21 demonstrating the various sectors which would be vulnerable to a pandemic. It can include special characteristics such as: Zero-coupon No coupon payments over the life of the bond.

Specifications of bonds can vary significantly and can be tailored to the investor. The effect of Covid in 2020 is undeniable. Municipal governments generally are very low risk, but it is not unheard of for a municipal government to default on a bond. Municipal bond defaults have been on a steady climb since 2018, and look set to continue that trend in 2021, a worrisome sign given that credit conditions are likely to only worsen from here.

0 kommentar(er)

0 kommentar(er)